Your Overview to Buying Commercial Qualities up for sale

Investing in business residential properties up for sale provides a special collection of possibilities and obstacles that need a critical method. Recognizing the various kinds of industrial properties, key aspects that influence their value, and the intricacies of marketing research are crucial elements that can dramatically impact your financial investment results. Navigating financing options and effective residential or commercial property management methods can additionally boost your returns. As you consider your access right into this market, it is essential to examine these components very closely to make certain an audio investment choice-- one that could bring about substantial economic gains in the future.

Kinds Of Commercial Characteristics

Industrial properties are often categorized right into a number of distinctive types, each offering particular objectives and attracting different sorts of financiers. The main classifications include office complex, retail rooms, commercial residential or commercial properties, multifamily units, and unique purpose properties.

Office structures are developed for organizations and can range from single-tenant homes to big high-rise buildings real estate multiple firms. Retail rooms encompass shopping centers, standalone stores, and malls, dealing with customer needs and choices. Industrial properties include storage facilities, producing sites, and distribution facilities, supporting logistics and manufacturing activities.

Multifamily units, such as apartment building, provide residential living rooms while producing rental revenue, making them attractive to financiers seeking stable money circulation. Special purpose residential or commercial properties offer one-of-a-kind features, consisting of resorts, restaurants, and self-storage centers, often requiring specialized expertise for efficient management and operation.

Comprehending these categories is critical for potential investors. Each kind provides special investment possibilities and obstacles, influenced by market demand, location, and economic problems. Capitalists must evaluate their economic goals and run the risk of tolerance when choosing the kind of commercial residential or commercial property that aligns with their method, inevitably guiding their financial investment decisions in this diverse market.

Key Variables to Take Into Consideration

When examining potential financial investments in business residential properties, investors often think about several crucial factors that can significantly affect the success of their endeavors. One primary consideration is the property's place. A prime place with high visibility and accessibility can bring in lessees and consumers, inevitably improving rental earnings capacity.

An additional essential element is the residential or commercial property's condition and age. A well-maintained residential or commercial property may need less prompt capital investment, while older structures may necessitate comprehensive remodellings, influencing general productivity.

Recognizing the zoning legislations and regulations is additionally important, as these dictate the kinds of businesses that can operate the property and may influence future growth chances.

In addition, examining the financial performance of the residential or commercial property, including current leases, rental prices, and occupancy levels, offers insight right into its income-generating capacity.

Performing Marketing Research

Extensive market study is essential for educated decision-making in industrial property financial investments. Comprehending the local market characteristics, consisting of supply and demand trends, rental prices, and openings prices, is necessary to determine the possible earnings of a property. Assessing group data, such as populace growth, income levels, and employment rates, can supply useful insights right into the location's financial viability and beauty to possible tenants.

Using on-line resources, neighborhood actual estate data sources, and involving with sector experts can improve your research initiatives. Networking with regional brokers and participating in neighborhood meetings can also produce vital information about upcoming advancements and zoning modifications. Inevitably, comprehensive market study equips financiers with the expertise essential to make strategic decisions, reducing risks and taking full advantage of prospective returns in business property investments.

Funding Your Investment

Protecting funding for your financial investment is a critical step that can dramatically affect your general success in the Check This Out industrial real estate market. A variety of funding alternatives are offered, each with unique advantages and considerations. Traditional financial institution financings are one of the most common choice, offering affordable rate of interest rates and terms. They generally call for a significant down payment and a robust credit scores background.

Alternative financing approaches include exclusive money loan providers and hard cash financings, which can help with quicker access to resources however frequently included higher rates of interest. Furthermore, take into consideration commercial mortgage-backed securities (CMBS), which give a wider pool of capital and might have much more versatile terms.

Another option is to discover partnerships or submissions, enabling numerous capitalists to merge resources for bigger investments. This can minimize individual monetary risk while improving purchasing power.

Despite the path picked, carrying out thorough due persistance is important. Analyze the terms, costs, and prospective return on investment related to each funding choice. Eventually, the ideal funding approach will line up with your financial investment goals and take the chance of resistance, positioning you for long-term success in the industrial real estate landscape.

Managing Your Industrial Property

Additionally, developing an extensive marketing method is crucial for attracting new occupants. Utilize online platforms, social networks, and neighborhood advertising and marketing to ensure your property reaches its target demographic. Take into consideration using competitive lease terms and rewards to fill vacancies quickly.

Finally, make sure conformity with neighborhood policies and property maintenance standards. you could check here Staying educated concerning lawful commitments can assist alleviate risks and stay clear of pricey charges - commercial you can look here sales listings melbourne. By prioritizing effective administration techniques, you can enhance the value of your commercial home and secure a lasting investment for the future

Final Thought

Investing in industrial residential properties provides significant potential for economic growth, supplied that cautious consideration is offered to different aspects. By comprehending the kinds of homes readily available and carrying out detailed market research study, investors can make informed decisions.

Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Suri Cruise Then & Now!

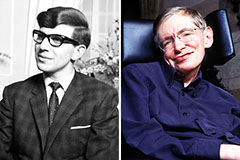

Suri Cruise Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!